Defendant Is Not A Jones Act Employer Nor Owner Of The Vessel

In a recent case, the Third District Court of Appeal addressed the inter-relation between the seaman status under a Jones Act claim and the controlling

In a recent case, the Third District Court of Appeal addressed the inter-relation between the seaman status under a Jones Act claim and the controlling

St. Joseph’s Altars in NOLA Every March 19th New Orleans celebrates St. Joseph’s Day by constructing altars all around the city. This tradition started in

How to Find the Best Body Shop for Your Car after a Car Accident Unfortunately, car accidents are inevitable sometimes. Even if you are not

The History of the Crawfish Boil If you’ve lived in NOLA and you’re not a vegetarian, you’ve probably attended a crawfish boil. Shoot, if you

Have you ever wanted to know how many complaints your insurance company has with the State of Louisiana Insurance Commissioner’s Office? After the 2020 Hurricane

Cinco de Mayo is just around the corner! Cinco de Mayo, or “Fifth of May,” commemorates the day in 1862 when the smaller Mexican Army

When you complete your vaccination shots, you will receive a Centers for Disease Control and Prevention (CDC) Covid-19 Vaccination Record Card. You should keep the

WHAT IS THE AMERICAN RESCUE PLAN ACT OF 2021? The House of Representatives is getting closer to passing the American Rescue Plan Act of 2021

President Trump ordered Governors to work with FEMA to set up a “Lost Wages Assistance Program” $300 weekly federal payments will supplement Louisiana unemployed

According to a recent laworks.net video, Louisiana has brought back the Work Search Requirement to receive Unemployment benefits “because $600 federal unemployment supplement has ended.”

The Coronavirus & $600 Per Week Louisiana Unemployment Claims The CARES Act signed into law by President Trump gives Louisiana eligible employees as well as

New Orleans is famous for Mardi Gras. Fat Tuesday is often seen as a time to celebrate and overindulge before the Lenten season. Success of

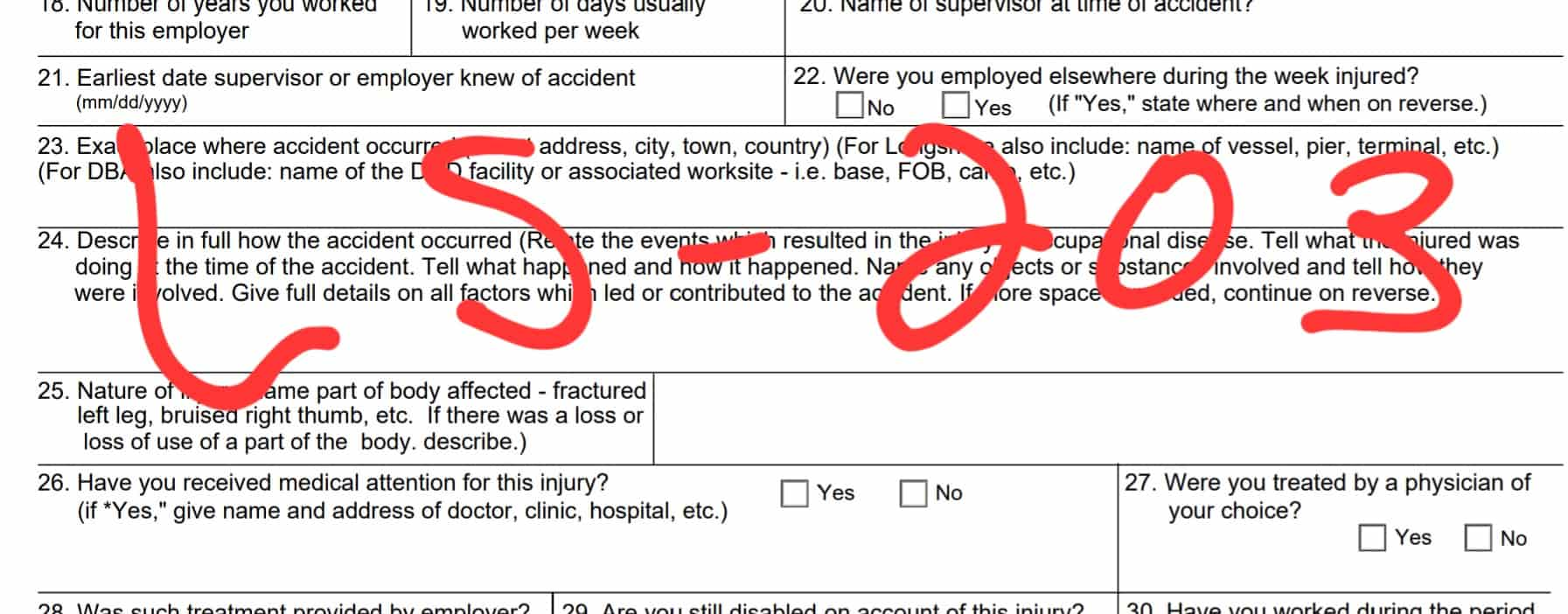

The LS-203 Form titled “Employee’s Claim for Compensation,” issued by the U.S. Department of Labor, Office of Workers’ Compensation Programs. This form, identified with OMB

Comparing the Coast Guard Boating Incident Report form with the Louisiana Department of Wildlife and Fisheries Operator Boating Incident Report form reveals both similarities and

Documenting & Photographing a Car Accident Scene: A Critical Step Amid New Orleans Police Department’s Response Delays & Failure To Show Up In light of

Louisiana’s diverse economy spans from the vibrant heart of New Orleans to the vast, oil-rich rigs dotting the Gulf of Mexico. While the state boasts