BEST Louisiana Workers Compensation Lawyer Near You

You may be wondering, “What is Louisiana workers’ compensation law?” or “Who needs workers’ compensation in Louisiana?” Under Louisiana law, Louisiana employers are required to carry workers’ compensation if they have 1 or more employees, full or part-time, whose payroll is at least $3,000.00 annually.

[lwptoc]

Jump to a Section:

ToggleWhat are Louisiana Workers’ Compensation Benefits?

If you are hurt on the job in Louisiana, unable to work due to the injury, and if your injury is covered by Louisiana Workers’ Compensation Act, your employer and its workers’ compensation insurer are obligated to pay for damages. In the event of death, Louisiana Workers Compensation death benefits are payable to your survivors. Before settling your Louisiana Workers’ Compensation Claim, you should be familiar with the various types of benefits owed and issues specific to workers’ compensation settlements.

Workers’ compensation payments are made regardless of fault on the part of the employer or employee. In exchange for the benefits, the employee generally waives the right to sue his or her employer in tort for pain and suffering damages. After a work-related injury and perhaps a visit to the hospital emergency room, the first thing an injured worker will need to do is to figure out who the employer’s workers’ compensation insurer is. You should also call a workers’ compensation attorney near you in Louisiana (or a defense base act lawyer if applicable) to help you in your specific situation.

Our Louisiana longshore harbor death benefits lawyer can also help if a loved one was killed while working on the job.

Louisiana Workers Compensation Settlement Chart

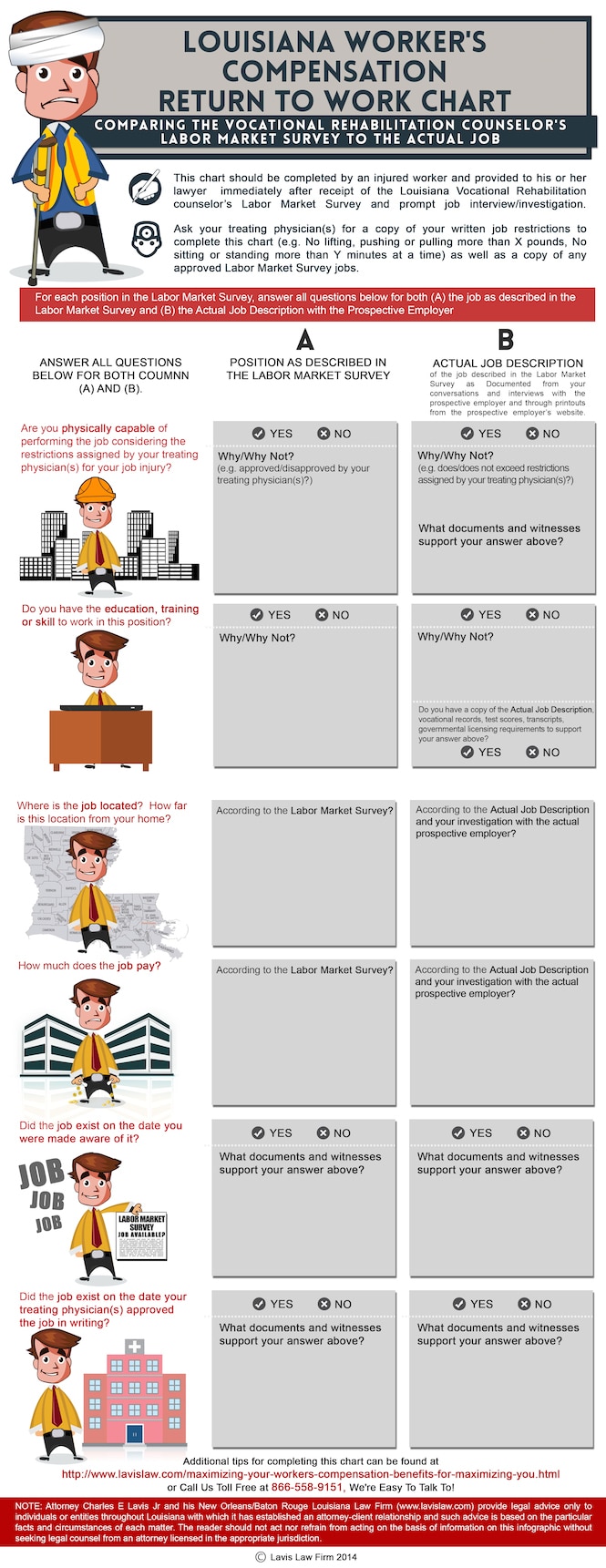

In most Louisiana Workers’ Compensation Act cases, the injured worker’s employer of the injury and their Louisiana Workers Compensation Insurer will try to reduce the amount of the injured worker’s weekly checks by converting the weekly benefits from Temporary Total Disability Benefits (“TTD”) to Supplemental Earnings Benefits (“SEB”). This can be accomplished by using a Vocational Rehabilitation Counselor’s Labor Market Survey.

It is very important for disabled workers to be actively involved in the vocational rehab process and to discuss work limitations with their treating doctor(s). Injured workers should consult with their workers’ comp lawyer in Louisiana about using the chart below immediately upon receipt of the labor market survey for purposes of comparing the workers’ compensation insurance company’s Labor Market Survey to the real job.

What Am I Entitled To Under A Louisiana Worker’s Compensation Settlement?

There are a few different categories of compensation you’re entitled to when you’re injured on the job. Not all of these may be applicable, but each should be explored as you work towards an equitable settlement with your employer.

- Lost Wages

While this may be intuitive to some, lost wages involve the hours you have not worked to date, as well as the future hours you may miss due to a modified or limited capacity, doctor appointments, surgery recovery, etc. Figuring out the right number can take some complicated calculations and firm negotiation with the worker’s comp insurance company to ensure your settlement is adequate to cover everything past and future. - Physician Choice

While you can choose one doctor in any field of specialty, if you’d like a second opinion, or to change doctors completely – you must ask for permission from the worker’s compensation insurance company involved. This can be a delicate dance and one way for an insurer to control your access to care during this process. It’s a battle you may need help to fight. - Medical Benefits

This seems like a no-brainer, but like lost wages – medical benefits need to apply to past medical bills, and any you may incur in the future. An experienced partner in this journey can help you obtain the right funds to help with rehabilitation, physical therapy, future surgeries, and more. - Mileage

If you or a family, friend, or assistant has to incur mileage on a vehicle to get you to and from doctor appointments, physical therapy, occupational therapy, or vocational rehabilitation – reimbursement amounts need to be factored into your settlement. This should also include a forecast of future miles you need to drive for all of your appointments. - Vocational Rehabilitation

An injury that results in you no longer being able to do the job you were hired to do can be heartbreaking. It can lead to uncertainty and questions about how you’ll support yourself and your family. If you can no longer work the job you had while you were injured after you’re well – worker’s compensation insurance may pay to train you in another job or trade. - Wrongful Death

In the extremely unfortunate event of the death of an immediate family member, not only should workmen’s compensation be involved, your case may be a candidate for a separate wrongful death suit against the company if negligence was involved. Your best bet is to call our team of experienced workers’ compensation lawyers near you to help you navigate this terrible and complicated situation as we are well versed in navigating these matters.

If you or someone you love was hurt on the job, it’s important to ensure your past, current, and future medical care, work loss, rehabilitation, and even pain and suffering are taken care of. There isn’t really a formula we can share to help you calculate this on your own.

Call our expert Louisiana workers’ compensation lawyers near you today to discuss your case. We can help you determine what’s possible, and what you’re entitled to as part of your worker’s comp settlement.

Louisiana Workers Compensation Death Benefits

Louisiana Workers Compensation Death Benefits provide payment to the deceased employee’s family, including a $8,500 funeral benefit.

Who Receives Louisiana Workers’ Compensation Benefits and In What Order?

Dependents are paid according to this schedule:

- Widow/Widower (“Widow”): 32 ½ % of employee’s average weekly wage

- Widow and One Child: 46 ¼ % of employee’s average weekly wage

- Widow and Two or More Children: 65% of employee’s average weekly wage

- If no Widow & One child alone: 32 ½ % of employee’s average weekly wage

- If no Widow & Two Children alone: 46 ¼ % of employee’s average weekly wage

- If no Widow & Three or more Children alone: 65% of employee’s average weekly wage

- If no Widow or Children, then to dependent father or mother: 32 ½ % of employee’s average weekly wage

- If no Widow or Children, then to dependent father and mother: 65% of employee’s average weekly wage

- If there are neither widow, widower, nor child, nor dependent parent entitled to compensation, then to one brother or sister, 32 ½ % of employee’s average weekly wage with 11% additional for each brother or sister in excess of one.

- If other dependents than those enumerated, 32 ½ % of employee’s average weekly wage for one, and 11% additional for each such dependent in excess of one, subject to a maximum of 65% of employee’s average weekly wage for all, regardless of the number of dependents

If the employee leaves no legal dependents, whether biological or adopted, entitled to benefits under any state or federal compensation system: one lump sum payment of $75,000 shall be paid to the employee’s surviving biological and adopted children who are over the age of majority, to be divided equally among them, which shall constitute the sole and exclusive compensation in such cases. If none, then one lump sum payment of $75,000 shall be paid to the employee’s surviving biological and adopted children who are over the age of majority, to be divided equally among them, which shall constitute the sole and exclusive compensation in such cases.

If the employee leaves no legal dependents and no biological or adopted children entitled to benefits under any state or federal compensation system: $75,000 shall be paid to each surviving parent of the deceased employee, in a lump sum, which shall constitute the sole and exclusive compensation in such cases.

Again, all of these Louisiana workers’ compensation cases are different and difficult to navigate. Especially in situations where the employee is a federal employee under the Federal Employers’ Liability Act. We urge you to call our workers’ compensation lawyer near you in Louisiana to help you through the process.

How Long are Louisiana Workers’ Compensation Benefits Paid?

The fee schedule in Title 40, Labor and Employment of the Louisiana Administrative Code sets forth rates for reimbursement according to Current Procedural Terminology (CPT) codes. In the event there is no procedure code because of the procedure is relatively new, the reimbursement is made by report (“BR”). In this situation, it may be best for the healthcare provider to negotiate the fee before the procedure is performed otherwise the provider may be faced with negotiating the fee after the procedure is done.

Surviving spouses are paid the death benefit until remarriage (at which point a lump sum of two years is paid) or death, while dependent children are paid the benefit until the age of 18 or 23 if they are a student or an older age if the child is physically or mentally incapacitated from earning. Other dependents are paid as long as their dependency exists or terminates upon their death.

How Do They Calculate Louisiana Workers’ Comp Settlements?

There is no Louisiana Workers’ Compensation settlement calculator. The value of any possible lump sum settlement hinges on many things, one of the most important is the injured worker maintaining his or her rights to indemnity, medical, mileage, and vocational rehabilitation benefits. What benefits are owed and still being paid? What is owed and not being paid? What is not owed? A Louisiana workers’ compensation lawyer near you may be helpful in helping an injured worker keep his or her benefits. It is usually easier to maintain benefits than to attempt to restart them once they are lost.

The injured worker or surviving dependents (in case of death) never need to settle their claims for future benefits and neither does the employer and insurance company. The injured worker cannot force the insurance company and employer to pay all of her future indemnity, medical mileage, and vocational rehab benefits all at one time; that can only be done by the agreement of the parties. Although the injured worker who is receiving weekly payments will probably live a long life, the insurance company will argue that he or she might die tomorrow in a car accident or some other reasons unrelated to the work accident, making the comp claim near worthless.

Some things to consider when valuing and settling a Louisiana Workers’ Compensation case include the following:

- What type(s) of indemnity benefits are being paid? Are all benefits being paid? Is there a time limit (number of weeks, age limit, limitation on remarriage, etc) on the type of benefits being paid?

- When was the last indemnity, medical, mileage, or vocational rehabilitation benefit paid? What are the time periods for asserting rights to unpaid benefits?

- Has a disputed claim for compensation been timely filed on any unpaid benefit? If so, who is the judge presiding over the case? Do the documents, witnesses, and other evidence support the claims?

- Has the accident-related medical condition stabilized?

- Is the medical condition causing the disability or death related to the accident?

- Is there some condition the injured worker did after the accident that prevents him from finding employment?

- What are the treating doctor’s recommendations for future medical care?

- Has the Average Weekly Wage been calculated correctly? Does it include overtime, vacation pay or any other taxable wage benefit?

- Is the correct comp rate being paid?

- Is the Labor Market Survey legitimate? Does the job really exist? Is the injured worker able to do it given his education and training? Did the treating doctor approve the position? Is he physically capable of performing the real position set forth in the Labor Market Survey?

- What is the injured worker’s life expectancy?

- In the event of death, have the funeral expenses been paid?

- Social security disability or retirement benefits received?

- Social security disability spread language about life expectancy included in the proposed settlement documents. What impact will the settlement have on Social Security Disability benefits being received?

- Are past, indemnity, medical, and mileage benefits owed; have hospitals, doctors, physical therapists, and other providers been contacted to see if all healthcare providers have been paid?

- Outstanding liens, including Medicaid, Medicare, Child Support, Attorney fees, costs, anything else etc.

- Future medical care and prescription medication,

- Medicare’s interest in the settlement- has an accurate Medicare Set Aside been submitted to CMS for approval?

- Will both the indemnity and medical be settled at the same time?

- What is the value of any other claims (tort, discrimination, unpaid wage, wrongful termination etc) owed by the employer?; Settlement language for these other types of claims will probably be included in the Settlement Documents and Release.

- What the actual settlement documents and release say and what they are supposed to say? – More often than not, they do not say what was promised by the insurance company and employer and need to be revised;

- The value of any related third party claim and whether it makes sense to settle both the comp claim and third party claim at the same time;

- What, at the end of the day, does the injured worker expect to do with the rest of his life, for work, medical treatment, etc.

Workers Compensation Settlements in Louisiana

For job injuries falling under the Louisiana Workers Compensation Act, the Act provides that a lump sum settlement is permitted only

- (1) Upon agreement between the parties, including the insurer’s duty to obtain the employer’s consent;

- (2) When it can be demonstrated that a lump sum payment is clearly in the best interests of the parties; and

- (3) Upon the expiration of six months after termination of temporary total disability. However, such expiration may be waived by consent of the parties.

Furthermore, a lump sum or compromise settlement entered into by the parties must be presented to the workers’ compensation judge for approval through a petition signed by all parties and verified by the employee or his dependent, or by recitation of the terms of the settlement and acknowledgment by the parties in open court which is capable of being transcribed from the record of the proceeding.

The settlement typically includes a settlement of any and all claims the employee may have whatsoever against the employer and its insurer, including past, present and future medical benefits, indemnity payments, vocational rehabilitation benefits, mileage benefits, penalties, attorney fees, interest and any other potential claims the employee may have against the employer or its insurer and their representatives.

Who Are Some Louisiana Workers Compensation Insurers?

An employer often refuses to provide the injured employee with the name of its insurer in an attempt to try to discourage the employee from making a claim or might try to encourage the injured worker to use his or her health insurance. However, in Louisiana, health insurance usually does not provide primary health insurance coverage for a work-related injury unless the employer and its insurer deny that the employee’s injury is compensable under the Louisiana Workers Compensation Act.

If you are in this situation, get a Louisiana workers’ compensation lawyer. Action on your part—a letter to the employer or filling a disputed claim—may be required to determine who the insurance carrier is. Popular insurance companies include Louisiana Workers’ Compensation Corporation (LWCC), CNA, AIG, Liberty Mutual, Travelers, Sea Bright Insurance Co., The Hartford, and Chartis. If you decide you do not want to get a lawyer involved at this stage of the claim, you can also try to determine who the insurer is by clicking on “Workers Compensation Coverage Verification” on the Louisiana Department of Labor page.

Louisiana Department of Labor District Offices

There are several Louisiana Workers Compensation District Offices that serve specific parishes with a complete list of the Judges, Mediators, Dispute Resolution Specialists, mailing addresses, phone numbers, fax numbers, email addresses, and Parishes served.

Louisiana Workers’ Compensation Premium Fraud

The scenario that is usually associated with the phrase “workers’ compensation fraud” involves an unscrupulous employee who schemes to collect insurance money. He does this by fabricating an injury, falsely reporting that he cannot return to any work while taking employment on the side, or other deceptive methods. The most insidious and costly form of workers’ compensation fraud, however, is “premium fraud,” which occurs when an employer attempts to cut costs by reporting inaccurate employee records. According to the Louisiana Workforce Commission, “Workers compensation fraud is costing the industry and citizens of our state billions of dollars each year”.

In 2009, the owners of a drywall company in Lafayette, Louisiana were arrested on such charges. The employers avoided paying full insurance premiums by reporting that they had nearly 300 fewer workers on their books than were actually employed. Cases such as this are strong indicators as to why insurance premiums become exponentially more expensive, particularly for employers who are honest about their employment records. Premium fraud is more large-scale and costly for insurance companies to handle than simple claimant fraud. Financially, it makes sense that premiums would rise to cover the monetary loss that premium fraud creates.

Reporting an inaccurate number of employees is not the only way that some employers attempt to save money. Workers who are engaged in physically demanding or hazardous activities are more expensive to insure. The employee who spends more time sitting in front of a computer than operating a forklift is less expensive. In some cases of premium fraud, an employer may report that his employees are occupied crunching numbers in the office, when in reality they are using pallet jacks and lifting boxes. Premium fraud can occur on a purely financial level as well, if an employer pays his workers under the table rather than keeping accurate books. In the latter situation, insurance premiums would be cheaper for the employer who neglects to account for his “invisible” workers, who may be paid in cash or compensated in other ways.

Employers in Louisiana who strive for lower premiums, and use fraudulent means to achieve this end, continue to drive up the cost of insurance premiums for everyone else. Premium fraud should be reported to the Office of Workers’ Compensation Fraud Division or the Attorney General’s Office, so an investigation can ensue. If you are an employee, be vigilant about your employer’s method of payment how your job is classified. Premium fraud is a financially crippling practice that needs to be monitored and eliminated, in order to keep insurance premiums lower and help individuals who are honest in their approach to employment records and claim reporting.

Contact an Experienced Louisiana Workers’ Compensation Attorney Near You

The personal injury lawyers near you at Lavis Law Firm handle disputed claims for compensation and workers comp settlements at the Louisiana Office of Workers Compensation District Office, which is located in Harahan, New Orleans, Houma, Lafayette, Lake Charles, Baton Rouge, Covington, Alexandria, Monroe, and Shreveport.

If you need help or have any questions about your job injury, call me, a Louisiana or New Orleans workers’ compensation lawyer nearby, at 866-558-9151, or submit your inquiry online Please be advised that you may be facing important legal deadlines so don’t delay.

Check Out What Our Clients Are Saying About Our Workers Compensation Lawyers in Louisiana

I had the pleasure of meeting and being recommended by the internet. I was trying to help my young nephew who was suddenly thrust into the world of Workers Compensation after the death of his father in a work accident. Was very difficultJason on Google ⭐️⭐️⭐️⭐️⭐️