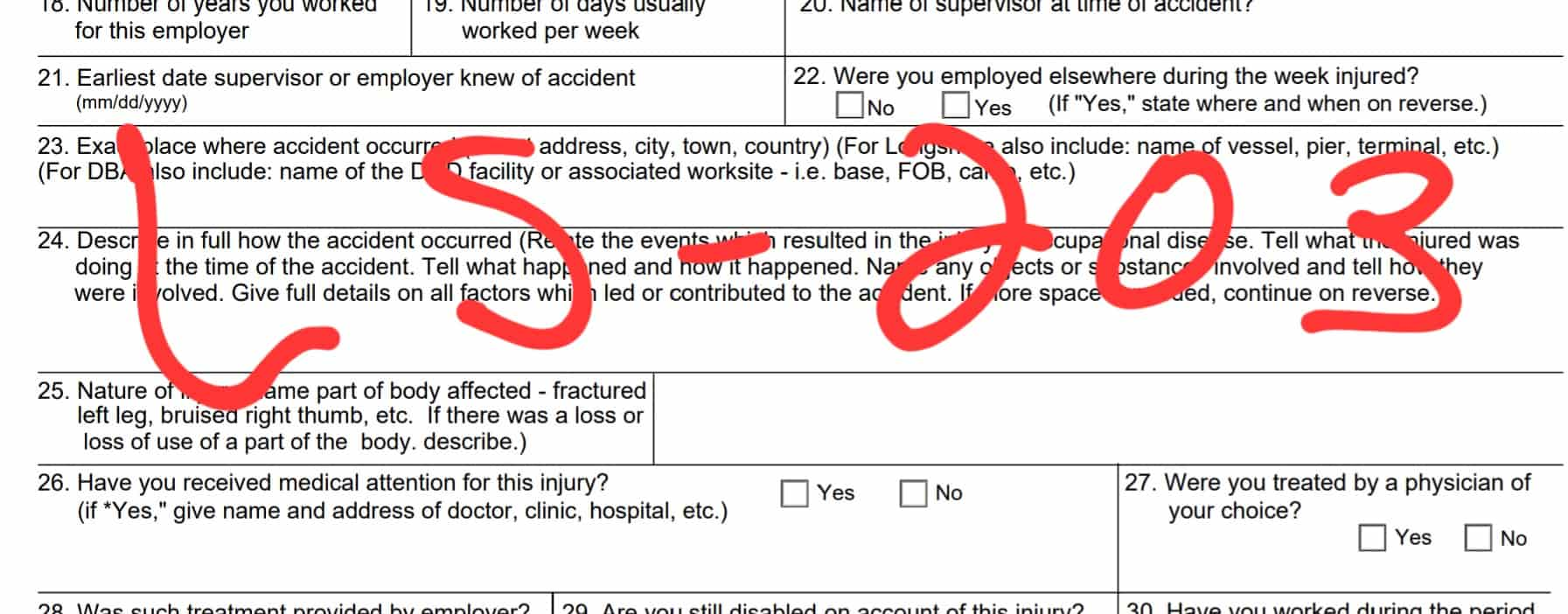

Information To Gather to Help Answer 38 Questions on a Longshore & Harbor Workers LHWCA Claim Form

The LS-203 Form titled “Employee’s Claim for Compensation,” issued by the U.S. Department of Labor, Office of Workers’ Compensation Programs. This form, identified with OMB